Year-over-year revenues of small business owners plummeted 52% according to the new Small Business Financial Health Survey, conducted by Biz2Credit.

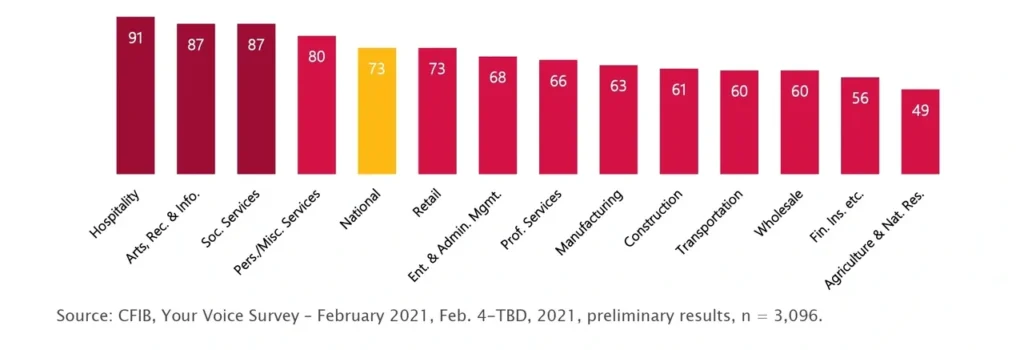

COVID-19 is putting a majority of small businesses in a precarious financial situation as only a quarter are making normal sales and over seven in ten reports having taken on debt to cope with the impacts of the pandemic according to a CFIB report about small businesses.

Seven in 10 small business owners have taken on debt due to COVID-19, with the average now reaching almost $170,000 per business, according to a new report from the Canadian Federation of Independent Business (CFIB). In total, small businesses in Canada now owe a collective $135 billion.

Businesses that took on debt due to COVID-19, by sector (% response).

But, what is next? What do Canadian entrepreneurs expect of 2022? According to The Canadian Entrepreneurs’ 2022 Investment Outlook released a few days ago 84 percent of businesses are planning to maintain investments or invest more in their business over the next 12 months. Also, 83 percent of businesses expect their sales will increase or remain the same, with accommodation and food service businesses the most optimistic, the study said.

Despite the fact that there are still some challenges, the entrepreneurs remain generally optimistic. And to meet those challenges, we have compiled four tips to face the new economic era and accelerate bounce back amidst economic downturns.

1. Resilient Businesses

One of the biggest advantages of being a small business is that they are more flexible than large companies. So, in order to bounce back in these uncertain times, it is important that business owners work out how to ensure that their model remains flexible in this ever-changing business landscape. One of the most prolific ways of achieving this is by learning from the hardships that were felt at the beginning of the pandemic and ensuring that businesses are more robust than ever before.

2. Seek Growth Opportunities

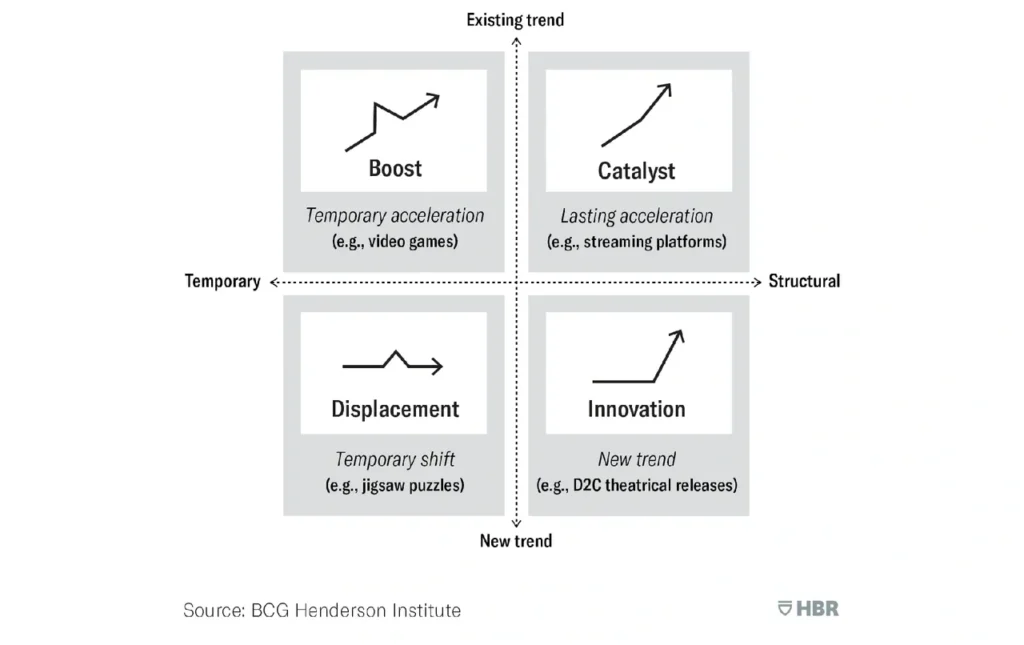

Companies seeking to emerge from the crisis in a stronger position must develop a systematic understanding of changing habits. Identify potential changes of behavioural trends to identify products or business opportunities that will most likely grow. Once you identify these demand shifts, businesses will need to classify them as to whether they are likely to be short-term or long-term and whether they were existing trends before the crisis or have emerged since it began. This framework can be used to highlight which trends to follow and which to shape more aggressively.

3. Don’t Stop Marketing

During an economic crisis, more than ever, it’s important businesses do whatever they can to stay top-of-mind for customers. So businesses should budget funds for marketing and do their best to stay in front of customers, focusing on digital marketing. The website is one of the most important ambassadors and a crucial component of a marketing and branding strategy for a business. Along with social media, they might be a powerful tool to reach new customers and engage with those that already knew you.